We'll shine a light on your business

So you can see clearly

- how you can improve profitability and generate more cash

- how you can target opportunities for growth

- how you can pay less tax

- how you can manage your cash flow to avoid nasty surprises

- how you can get your time back

How?

We take the time to get to know you and your business. We clarify your vision into a business plan with clear actions to achieve your goals and grow your business. We identify quick goals and longer term targets to improve profitability and generate more cash. We take care of the bookkeeping and accounting so everything is done on time. You get your time back. We look at every legal way to help you and your business save tax. And we keep working together to make it better.

Schedule a call with us today so you can start to see your business clearly

We work with companies and LLPs

We specialise in

- Start ups to £10m Revenue

- Financial Services

- Professional Services

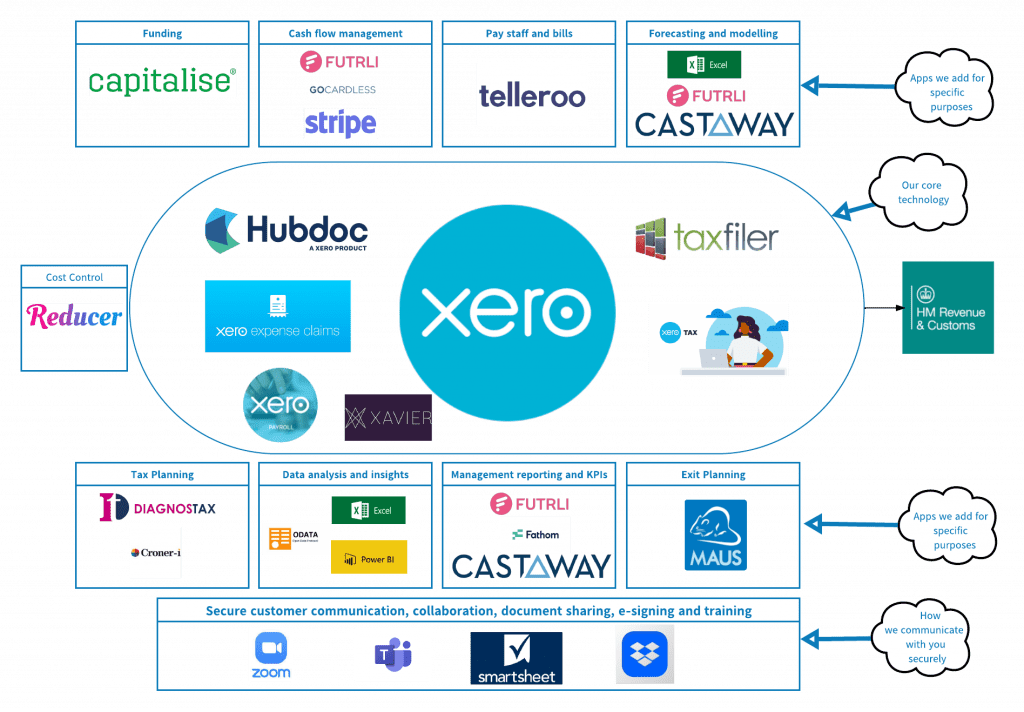

- Technology

We are Chartered Accountants. Xero Certified. We can be your Finance department or work with your Finance department. We package our services into 3 parts, and you can pick and choose from each of them. We have fixed and transparent pricing which we agree with you at the start. No nasty surprises.

Virtual Finance Office

A full range of services that is tailored for your business. We can be an outsourced Finance function or work with your team.

- Bookkeeping

- Credit Control

- Payroll

- VAT and Tax Returns

- Annual Accounts

- Management Accounts

- Cash flow forecasts

Business and Tax Advice

We give you the advice you need to set your goals in the most tax efficient way, with all the support to help you hit them.

- Goal setting and Strategy

- Business Plans

- Debt and Equity Funding

- Tax Planning

- R&D Tax Credits

- SEIS/EIS Compliance

- Equity incentives

Virtual Finance Director

When a permanent Finance Director is too expensive an option, get the benefit of an experienced FD at a fraction of the cost.

- Strategy and Financial Modelling

- Development of your Finance function

- Internal Controls and Risk Management

- Board reporting and Governance

- Funding and Investor Relations

- Organisation Review

- Exit Planning

We get it - running a business is hard work

As a business owner, do you struggle with any of these?

Overwhelm

Your current accountants aren’t there to answer your questions. Making decisions is guess work without up to date financial information. There’s no-one highlighting issues before they become real problems.

How we can help you to regain your mind freedom

- Real time cloud based data

- Ongoing and rapid support

- Timely management information

Cash flow

You don’t have cash flow forecasts so you don’t know what cash you need to keep. You don’t know how to minimise the tax on the money you draw. The business isn’t doing as well as it could so cash drys up.

How we can help you achieve financial freedom

- Cash flow forecasting and management

- Business planning and strategy

- Tax planning and optimisation

Time

Business is complex and it’s hard to delegate, so you have a hand in everything. Roles aren’t clearly defined, too much manual working not enough automation. Not enough time in the day.

How we can help you achieve time freedom

- Organisational review

- Technology advisory and training

- Process and Controls review

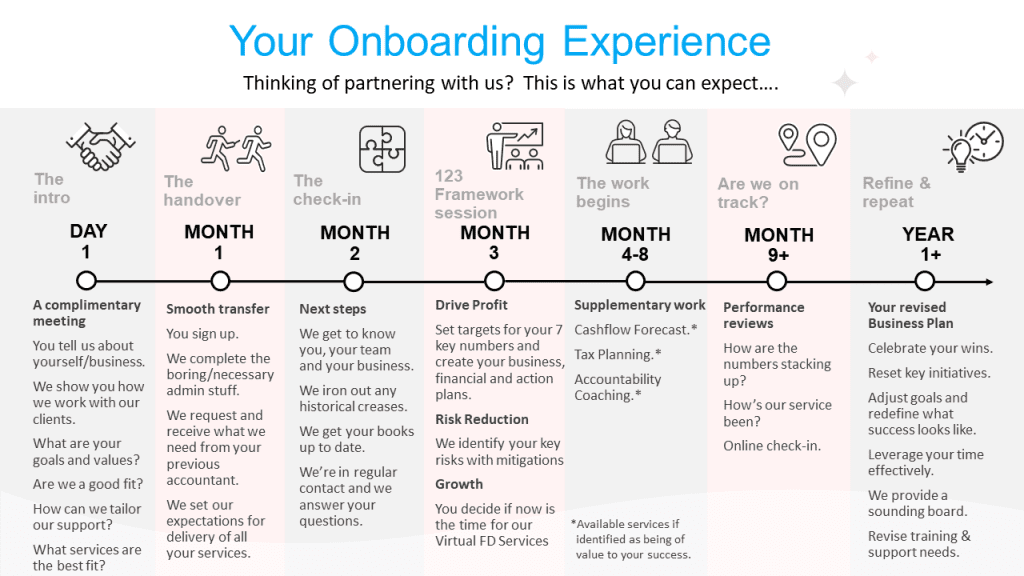

So how will we work with your busines to make this happen?

Schedule a Call

Use the link to schedule an intial 30 minute call, free with no obligation, to talk about the challenges you’re currently facing. If we both feel we're a good match then we'll follow that up with a more detailed discovery call

Get a Plan

In the discovery call we'll take time to get a better understanding of you and your business, so we can put together a plan with the steps we believe you should take to meet your goals, and select the services that you need to get you there.

Get Started

We start to work together. We get all the admin out of the way as soon as possible and get your books up to date, so we can start work on our Plan. It's all about getting results so we'll have monthly meetings with you to see where we are againt our key goals, and look at whether any corrective actions are needed to keep on track. We also start on the other services we've agreed such as cash flow forecasting and Tax planning.

Changing accountants is easier than you think..

From Day 1 we make sure the transfer is smooth and quick

Our Team

We’ve listened to our clients and understand what you value most – you want Trusted Advisers who respond quickly to your queries and communicate clearly to you without jargon. This is what our team always try to deliver.

Paul Campbell

Paul has the benefit of over 30 years’ experience in Finance to help him provide the best solutions for our clients to help them develop and grow.

Pam Campbell

Pam ensures we put customer service at the heart of everything we do. An efficient and automated business service can still be very human.

We are Xero Certified experts

We tailor the technology to your needs so you can have the most efficient and automated solution

Latest News

Our most recent posts are shown below

Inflation rate rises to 40-year high of 10.1%

The inflation rate rose to 10.1% in the 12 months to July, the highest level since February 1982. The rate has risen sharply over recent months and was up from[…]

Read moreSmall businesses given £21.3bn in Covid local authority grants

Smaller businesses across England received £21.3bn through the Covid-19 local authority business support grants scheme, but fraud levels were high. Estimates show that an estimated £1.03bn of grants were made[…]

Read moreUK insolvencies 33% above pre-pandemic levels

The number of company insolvencies in England and Wales jumped by a third compared to pre-pandemic levels in December 2021 The number of registered company insolvencies reported in December 2021[…]

Read more